3 Times Bounced Cheque Malaysia

In some countries bounced cheque is a criminal offence. Recently a Dubai-based British businessman serving a three-year prison sentence for bouncing cheques was released following a seven-week hunger strike which resulted in his conviction being overturned.

Everything You Need To Know About Cheque Bounce

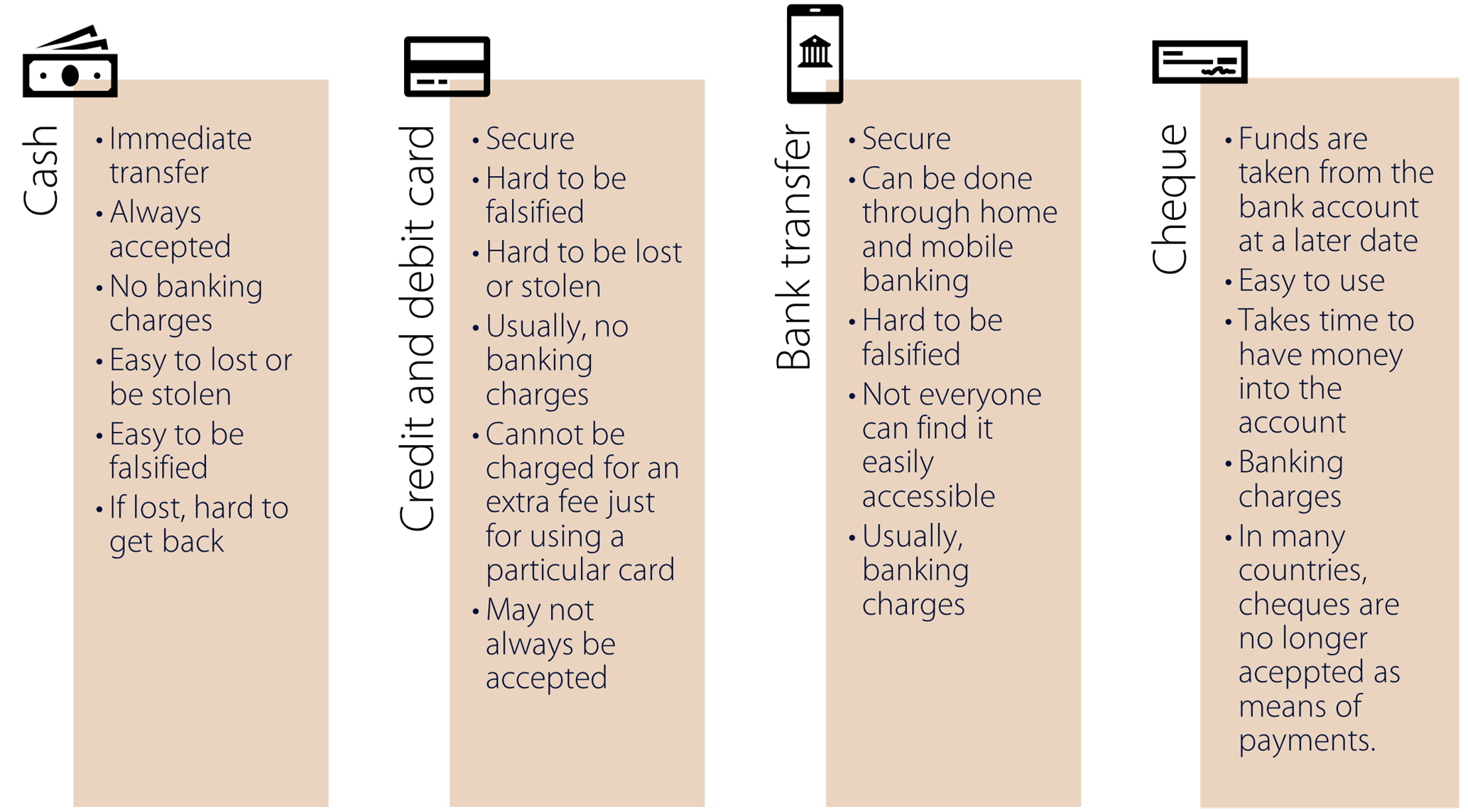

Although there is sign of decline from year 2007 onwards which is due to an emergence of electronic banking but cheque will remain high as the funds movement exceeded.

. When the cheque is due the lender will cash-in the cheque into the bank. A bad cheque offence occurs when you have committed three 3 bad cheque incidents within 12 months from the date of the first incident on the same account and it works on a rollover time. Where the amount of funds in the customers account is insufficient such a cheque will be returned unpaid by the bank.

A Cheque can be presented any number of times in the bank within its validity period. Cheque deposited by BOBs customer and returned unpaid Inward Return Up to 1 lac 125-. Each time a bad cheque is issued it is treated as a bad cheque incident.

For every bounce cheque u will b charge RM 100 IAANM 3 times n ur out UNLESS ur a big client then they will ring u up and let u know. Cheque bounce for inadequate funds in account. A cheque may bounce due to.

Return of cheques deposited at the home branch for local clearing 500-per cheque. A bounced cheque simply means a cheque that the bank refuses to pass or honour and is intimated to the issuer and the receiver and a nominal penalty is. According to the statistic from Bank Negara Malaysia Malaysian Central Bank it is evident that check payment is the most preferred payment method now and in times to come.

Outstation cheque deposited by the customer 150- other bank charges at actuals per cheque. Generally if a cheque is returned unpaid the cheque processing fee will not be refunded and will still be charged. Liability for bounced cheques in case of joint signatory authority.

The cheque is then returned unpaid or dishonoured. The banks return or dishonour the cheques also known as rubber checks in addition to imposing a. The severity of the consequence depends on the number of times the individual has committed a bad cheque offence.

A situation of cheque bounce is basically a term used to define the unsuccessful processing of a dispensed cheque due to several reasons. Dishonoured cheques are a risk at any time for local businesses but especially in times of economic recession. I sold my share and the memorandum of association changed.

However historic Isle of Man legislation exists to protect local business and residents against cheques bouncing. In money lending term the lender is offering cash in exchange of cheque which is not due. Whether we are a business owner or an employee if you have a post-dated cheque you can cash-out your cheque to get cash immediately.

Non-sufficient funds NSF in the issuers account is one of the primary reasons for a bounced cheque. Is cheque bounce maintainable or not if 3 times bounced In Cheque Bounce Law 1st time cheque presented on 12-12-2011signature mismatchdemand notice not sentagain presented on 9-1-2012signature mismatchdemand notice not sentagain presented on 15-5-2012 insufficient reasonsdemand notice sent complaint filed complaint maintainable or not. A cheque is bounced if the issuer writes a bad cheque - due to technical reasons like mismatch of signature or overwriting or also when there are insufficient funds in the account as result of it is not processed by the bank.

I was a partner in a company with joint signing authority for the bank account. The offender may be slapped with a huge. Consequences of a Bad Cheque.

Being a bad cheque offender in Malaysia has its consequences. 09055512063 sms only email protected You just realised that a cheque had bounced and you were wondering what would happen next. With Nike Popoola.

The drawee bank will issue you a warning letter for each bad cheque incident. The amount mentioned in the cheque exceeding the amount which has been arranged to be drawn from the account by virtue of a prior arrangement. The Act which deals with the punishment in relation to such cheque bounce and safeguards protection against the same is the Negotiable Instruments Act 1881.

Repeat offences can have serious repercussions. Under section 3 of the Bills of Exchange Act 1883 the Act a cheque is. However due to some reasons or busy schedule I could not change my signing authority from the bank.

In SL Construction v. Payee took post dated cheque because it is akin to promised to pay. A step-by-step guide for legal recourse The dishonour of cheque is a criminal offence and is punishable by imprisonment up to two years or with monetary penalty or with both.

Sometimes some companies are in genuine trouble and cant resolve the problems esp if the cheque holder is the asshole type who doesnt care and just banks in the cheque 3 times. With the introduction beneficiaries of outstation cheques will be able to use the funds within a shorter period of time compared to the current dayhold of 5 to 8 working days. Each time a a bad cheque is issued it is treated as a bad cheque incident.

Bank Negara Malaysia BNM introduced the Cheque Truncation and Conversion System CTCS on April 8 2008 to replace the current cheque clearing system. Provided though that they act swiftly. A cheque check becomes a bounced cheque when on being presented to the bank it is returned by the bank due to there being a defect in it.

The drawer or issuer will still be charged the cheque processing fee. This would include the case of a post dated cheque which is being presented by the beneficiary before the date of the cheque. Undated cheques whereby there is no clear date written on the cheque.

A cheque bounce can occur due to various reasons such as inadequate balance when the validity of the cheque has expired in case of a torn cheque overwriting in the cheque. Process of Cheque Cashing. Cheque bounce is a violation of the Act and attracts a.

If cheque has been bounced within three months three time than u have to send legal notice within 30 days from the date of last memo by demanding money within 15 days if payment is not made within 15 days than u can file complaint within. If a cheque bounce occurs due to insufficient funds or signature mismatch both the drawer and the payee are charged by their respective banks. However a bounced cheque can be redeposited.

The relaxed stance on the offence has been confirmed in an article by the National an Abu Dhabi daily newspaper.

Things To Know About Bank Cheque

Experts Write To Government On Cyber Fixes Last Year The Government Said It Planned To Release A New Cybersecurity Str Cyber Security Cyber Threat Cyber Attack

Bounced Cheques What Are The Legal Ramifications And Legal Recourse Available Thomas Philip Advocates And Solicitors Kuala Lumpur Malaysia

Bounced Dishonoured Cheque How To Prevent It From Being Bounced

New Rule For Cheque Payments Effective From January 1 All You Need To Know Business News

Landlords Have Called Out M Sian Startup Hom For Alleged Fraud We Got The Team To Respond Techilive In

Legal Remedies For Dishonour Of Cheque Law Times Journal

Saudi Arabia In Imf Staff Country Reports Volume 2013 Issue 214 2013

Computation Of Time In The Legal World Malaysian Litigator

The Limitation Period For Cheque Bounce Case During Covid 19 Vakilsearch

Filing Procedure Of Cheque Bounce Case Step By Step Guide For Legal Procedure

Covid 19 Live Updates First Case Of Brazil Based Virus Variant Found In U S The New York Times

4 Times A Personal Loan Makes Perfect Sense

Bounced Cheques What Are The Legal Ramifications And Legal Recourse Available Thomas Philip Advocates And Solicitors Kuala Lumpur Malaysia

Hpl Yamalova Plewka Dmcc Linkedin

0 Response to "3 Times Bounced Cheque Malaysia"

Post a Comment